GEF’s Annual Conference is our flagship event held each Fall in Greenwich, CT. GEF has built its reputation on the quality of our speakers, the seniority of our delegates, and the intimacy of our settings. In six years, GEF has become one of the world’s premier conferences for investors, asset owners, economists, and policy makers.

GEF conferences are elegant and intimate, and allow for real relationship building in a collegial environment.

To attend, please inquire to become a Member or Corporate Partner.

Delamar Greenwich Harbor – 500 Steamboat Rd Greenwich, CT 06830

Become a Member

Build lasting relationships with peers and clients by becoming an Individual or Corporate GEF member.

Memberships allow for unprecedented opportunities at our signature conferences as well as member dinners and cocktail events.

Become a Corporate Partner / Sponsor

Sponsoring GEF conferences provides a unique forum to showcase your thought leadership and perspectives, as well as extensive branding and marketing exposure and generally includes coverage by top international financial media.

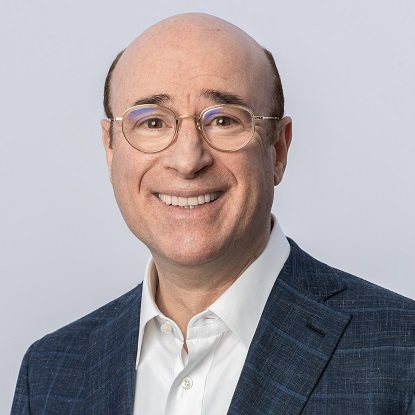

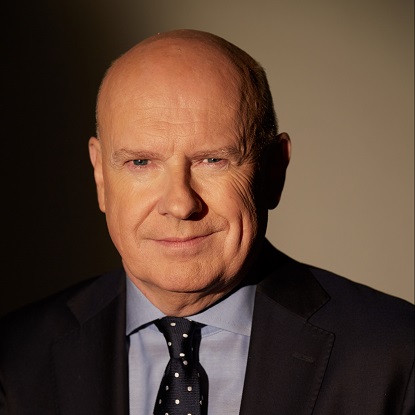

Name

Title

Company

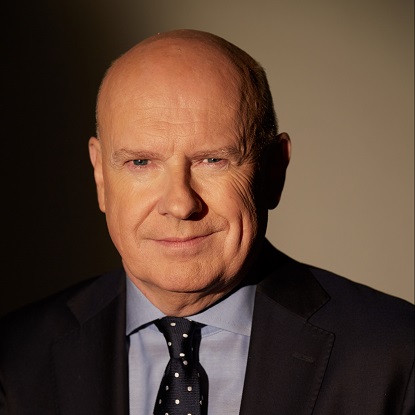

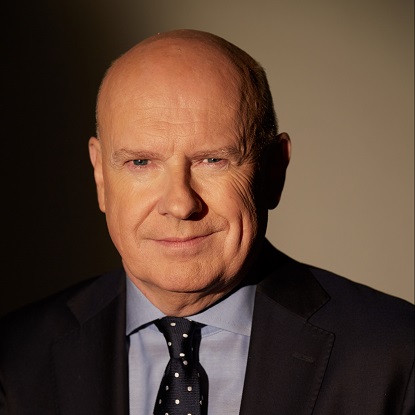

Name

Title

Company

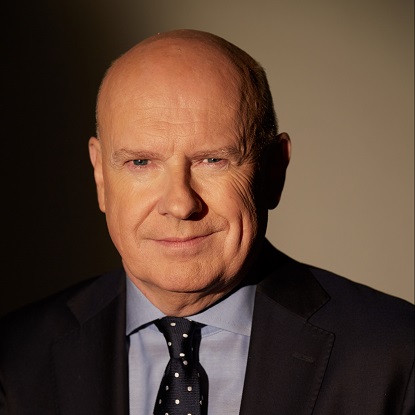

Name

Title

Company

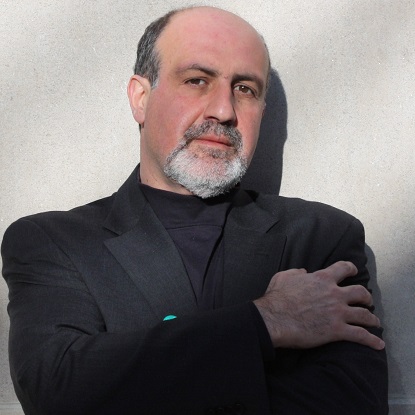

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

Name

Title

Company

2024 Speakers

Ray Dalio

Founder, CIO Mentor and Member of the Board

Bridgewater Associates

Brad Jacobs

Executive Chairman

XPO

Dina DiLorenzo

Co-President

Guggenheim Investments

Frank McCourt

Executive Chairman

McCourt Global

2023 Greenwich Corporate Partners

International Media Converage